Rapid pace on how technology evolves and society’s demand for constant content has shaped today’s streaming service industry. Giant streaming service Netflix for example has established the behavior and pattern of how consumers value the instant gratification of consuming content anytime and anywhere.

In fact amidst the pandemic era, the streaming service industry thrived and rapidly expanded its content and market reach. With its potential untapped market, Southeast Asia had caught the attention of many of these streaming services in the last few years which at present is dominated by Netflix. From global corporations such as Disney and Amazon to Indonesian start-up streaming services such as Vidio, they all want a piece of the pie. In this two part blog post series, we’ll be uncovering the market penetration of Netflix in Southeast Asia in 2022.

Netflix in Southeast Asia – How Relevant Are They Today?

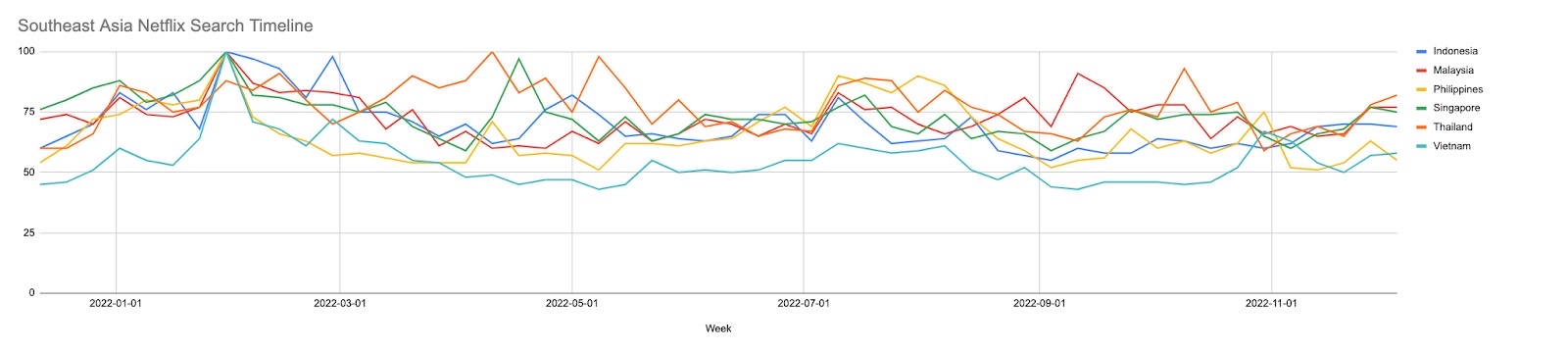

With news of job cuts and membership decline across the globe, we couldn’t help but wonder – is Netflix still relevant? The answer in Southeast Asia is absolutely. According to search volumes, the total number of searches for Netflix in the last year has been consistently high with some countries doing much better than others. When analyzed further, we get the sense that weekly search volume especially increases depending on the latest content released in these countries.

Netflix growing subscribers in SEA amidst global subscriber loss

Despite the number of subscribers for Netflix plummeting globally in 2022, (with 200,000 subscribers lost in the first quarter and nearly a million subscribers in the second) the good news comes in the third quarter for Netflix, which added more than 2.4 million subscribers outside the United States.

Interestingly, Asia was the one region where Netflix grew its subscriber base in the first quarter, promising an overseas market for Netflix. It added 1.1 millions Asian subscribers, while losing a combined 1.3 million in other regions and predicting a loss of 2 million subscribers in the next quarter. One of the highlights in Netflix’s first-quarter results was the positive growth in Southeast Asian countries such as the Philippines.

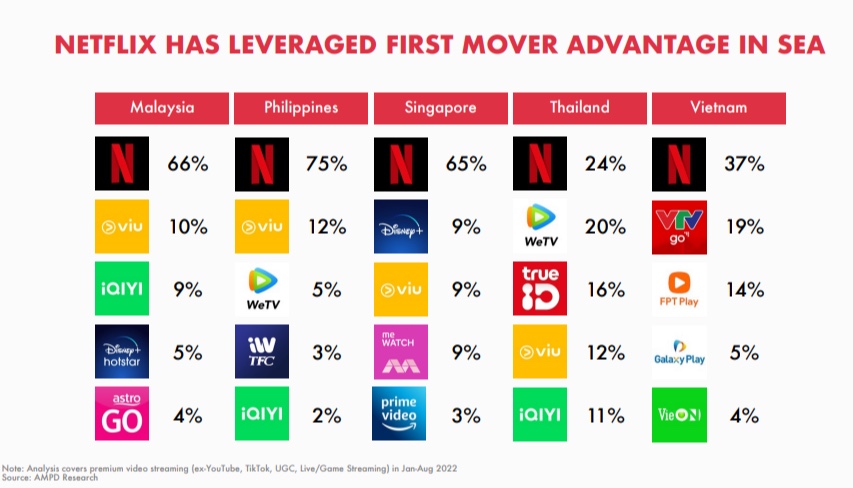

In fact, Netflix is the dominant subscription video service in most of Southeast Asia’s market, excluding Indonesia with Disney taking the lead. While most streaming services have less market presence in Asia, Netflix had the upper hand, since they came first and generated more revenue in the Asia Pacific than Prime Video and Disney+ combined.

Based on the statistics of most popular subscription video on demand (SvoD) services in Indonesia as of May 2021, Netflix is ranked first in Indonesia with 72.29%. As of December 2021 in Southeast Asia, Netflix ranked third with 6.8 million subscribers behind streaming platform Viu (7 million subs) and Disney Hotstar (7.2 million subs).

According to a new analysis published by Media Partners Asia (MPA) in Q1 2022, Southeast Asia (SEA) added 2.8 million new SVOD subscriptions, reaching an aggregate customer base of 39.5 million total. Netflix held the premium video consumption share in the rest of Southeast Asia (excluding Indonesia), with content breadth across premium US series and movies, Korean dramas, Japanese anime and international originals serving Southeast Asia audiences.

These numbers prove that Netflix has a strong market penetration in Southeast Asia and the streaming service industry is steadily growing in the region, with Netflix and its rivals closely competing.

A Market Eager for International Content

The driving factor supporting the booming streaming service market in Southeast Asia is due to its population. With nearly 700 million people, the population accounting for a large percentage of this diverse groups of people are young and eager to consume international content.

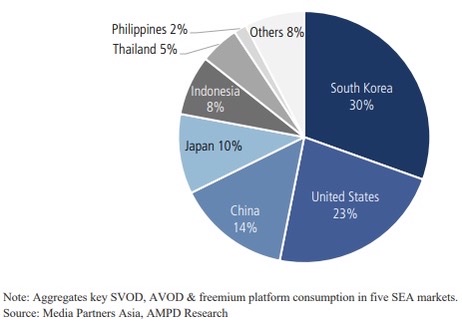

Interestingly, the demand for content from Southeast Asian audiences are predominantly from South Korea with 30% beating US content (at 23%). When investigated further, we uncover that US content was largely consumed by Philippines, Malaysia and Singapore, driving up to 33-44% of measured consumption, according to AMPD. In that sense, countries like Indonesia are still largely an untapped market for Netflix when compared to their competitors.

A Look into Netflix’s Rivals

Vidio: Indonesia’s local champion

As a thriving OTT (over-the-top) streaming platform based in Indonesia, Vidio has over 60 million viewers per month and in the second quarter of 2022 ranked first in subscriber growth and popularity for original content. Vidio also became the second largest SVOD (subscription video on demand services) operator in Indonesia in terms of subscribers after Disney+ Hotstar with a record quarter to reach approximately 3.5 million subscribers.

The secret of Vidio’s success lies in its library of extremely localized content and sports programming. As stated on the research of AMPD, Q2 growth was driven by Vidio’s strengthened local originals slate, key sports broadcasting and the movement of more content to the paid tier. Vidio’s achievement is simply proof that every market in Southeast Asia has its own characteristics and is driven by the interests of the local audience.

Disney+ exceeds 5 mil subscribers in Indonesia

While Vidio has garnered some impressive numbers, Disney+ Hotstar is the most subscribed SVOD operator in Indonesia, exceeding 5 million subscribers. One of the secrets behind the success was to partner with local provider Telkomsel to bundle the subscriptions with mobile data plans. According to AMPD Research, in Q2 of 2022, Disney’s 2022 Korean slate has been impactful, while Marvel and kids [content] remain important. Furthermore, Rebecca Campbell, chairman of the company’s international content and operations, said that Disney wants to serve its viewers in every market with locally produced stories that resonate with the audience; meaning local content from Disney is expected.

Amazon Prime Localizes for Indonesia, Thailand, and Philippines

While Korean and US content remains critical for Southeast Asian countries across the board, it’s evident that some markets in the region crave more local content. In fact, Amazon Prime seized this opportunity in August when they launched their ‘localized experience’ for its streaming service in Southeast Asia’s biggest markets — Indonesia, Thailand and Philippines.

From there, original content was introduced to the platform with a wide range of genre, such as Comedy Island, the remake of italian movie Perfect Strangers in Indonesia, The 100 thriller in Thailand, How To Love Mr. Heartless romance in the Philippines, and many more.

Localized content has proven to gain traction for Amazon Prime since it offers relatability to its viewers. Netflix has also attempted to localize content in Indonesia with Waktu Indonesia Netflix, a slate of upcoming made-in-Indonesia films and series with a wide range of genres as well, and Thailand with the latest slate including four films and two series.

For Netflix to thrive, it needs to find an edge amongst its competitors. Between finding the right local content to produce or stream and bringing in the right type of South Korean content, the best way to win the hearts of the market is to dig deeper in the psychographics of each market.

In our next blog post, we’ll dig a little deeper on what types of series were streamed the most on Netflix. Stay tuned for part 2!

Related Posts

27.01.2022

Unpacking Southeast Asia’s Hate-Watching Phenomenon for Emily in Paris

In order to understand the nature of hate-watching TV shows, specifically Emily…

13.10.2020

50 Ideas to Diversify Your Content Marketing Strategy

How can we as brands talk about the same things on social media but in a way…

06.03.2020

The Future of Content Marketing | Podcast S02E07

In the blink of an eye, we now find ourselves in the year 2020. In this…